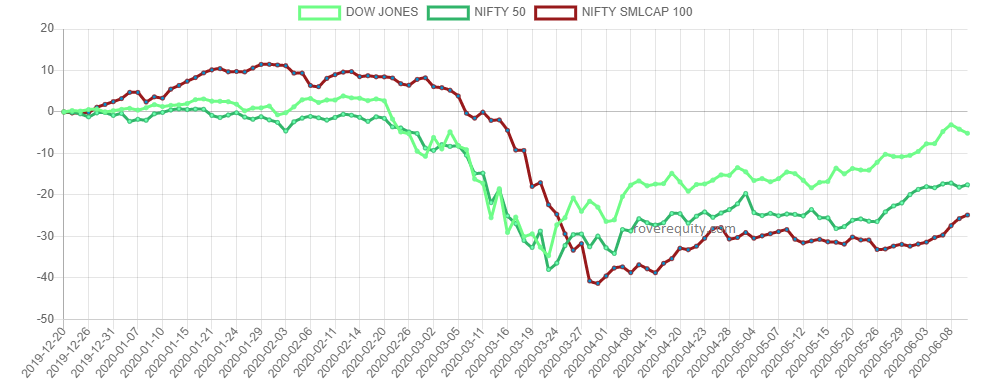

12-Jun-2020 : The fund managers and market experts have continuously advising to buy quality stocks and avoid medium and small cap stocks. But in the last one month, medium and small cap stocks gave handsome return in comparison to large cap stocks. On 23rd March, 2020, Nifty hit a closing of 7610. After that Nifty and Nifty Midcap index went almost shoulder to shoulder in terms of percentage gain or loss. Nifty small cap lost less ground in the same period of time.

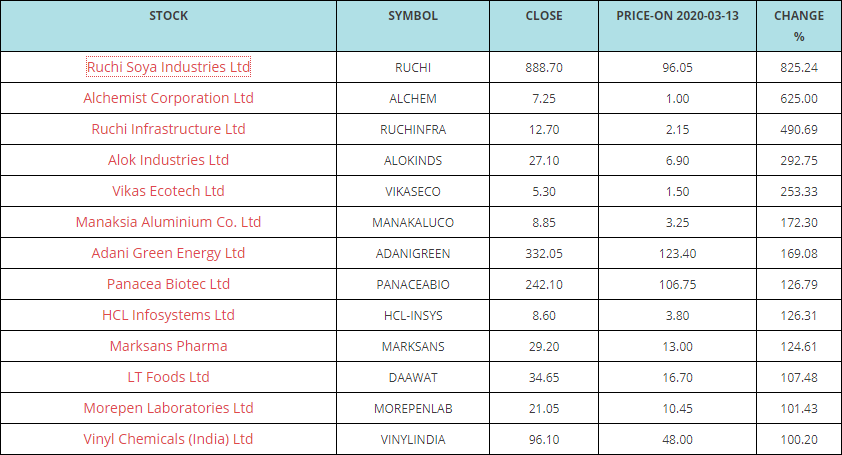

Few small cap stocks returned between 100% and 900% in the three months. Among all these stocks, Ruchi Soya is the most prominent one. On 13th March, Ruchi Soya was closed at Rs 96.05 per share. As on 11th June, the same stock closed at Rs 888.70 per share. Thus it gave a profit of 825% in this period. In this same period, penny stock Alchemist Corporation gained 625%, from Rs 1.00 to Rs 7.25. Similarly Ruchi Infrastructure gave a profit of 490%. Other stocks like Alok Industries, Vikas Ecotech, Manaksia Aluminium, Adani Green, Panacea Biotec, HCL Infosystem, Marksans Pharma, LT Foods, Morepen Laboratories and Vinyl Chemicals appreciated between 100% and 300%.

However, all these moves are not always backed by fundamentals. So if you are an investor, you need to take a call with lots of investigation about the stock. The traders may can take call based on their risk appetite. Now the market is very much volatile and can give wild swing at both the directions. So strict stoploss needs to be adhered.

Written by Research Analyst (SEBI Registered) Suvendu Manna

Disclaimer : The research analyst has No position in the aforementioned stocks as on the date of writing this article.

I, Suvendu Manna, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer(s) or securities. We also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Other Disclosures:

This report is a view of the Research Analyst as mentioned above and not a solicitation for purchase or sale. This report is solely meant for personal use and not for circulation. The information and opinion contained herein have been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guarantee, representation of warranty, express or implied, is made to its accuracy, completeness or correctness.

The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. We accept no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other Jurisdiction, where such distribution, publication, availability or use would be contrary to law.FacebookTwitterEmailWhatsAppSaveShare